As an integrated supervisory authority established in 2002, the Austrian Financial Market Authority brings together the supervision of all significant providers and functions under a single roof.

Primarily, the Financial Market Authority supervises banks, insurance undertakings, Pensionskassen (pension companies), corporate provision funds, investment firms and investment services providers, investment funds, financial conglomerates and stock exchange companies. Additionally, it also monitors compliance with legal requirements, fairness and transparency in relation to trading of stock-exchange listed securities (the supervision of markets and stock exchanges); that for securities that are to be offered to the public that comprehensive prospectuses are issued that portray the opportunities and risks associated with the investment in an appropriate manner (supervision of capital market prospectuses); that the principles of good governance and orderly advice are adhered to (supervision of compliance and rules of conduct); that the unauthorised offering and provision of financial services is prohibited and punished; and that all financial institutions have the necessary systems in place to work preventively in relation to money laundering and terrorist financing.

- 473 banks (excluding EEA branches and payment institutions)

- 8 corporate provision funds

- 78 insurance undertakings

- 8 Pensionskassen (pension funds)

- 65 investment firms and 45 investment services providers

- 10,624 foreign funds, which are marketed in Austria

- 2,070 Austrian investment funds managed by 14 investment fund management companies (of which 13 licensed as AIFMs ), 4 companies exclusively licensed as AIFMs , as well as 34 registered AIFMs

- 5 real estate investment fund management companies (at the same time AIFMs )

- 107 issuers with 22,572 listed securities as well as 69 million notified transactions

“One-Stop-Shopping”

As an integrated supervisory authority, the Financial Market Authority enables “One-Stop-Shopping”, so that all procedures to be conducted by the authorities can be handled under one roof. As an authority the Financial Market Authority has sovereignty: It is able to issue binding standards, like regulations and administrative decisions, to take coercive measures, such as withdrawing licences, to remove directors or to impose administrative penalties (in the case of natural persons of up to Euro 5 million, in the case of legal persons up to Euro 10 million or up to 15% of total net turnover (in the event that such an amount is greater than Euro 10 million)). It accompanies supervised entities across their entire lifecycle: from granting a licence, which authorises them to commence business operations, followed by ongoing supervision throughout their business activities, through to their liquidation, removal or surrendering of their licence.

The advantages of integrated supervision

There are convincing advantages for integrated supervision – it is the structure of the future for the Austrian financial market.

- An integrated supervisory authority is faced with a strongly interlinked financial market in Austria

- Cross-sector microprudential and macroprudential supervision allow a consistent approach to risk analysis backed up by effective measures

- The integrated approach also permits a coordinated approach in shaping European and international supervisory law

- Conduct supervision and prudential supervision under a single roof are the keystone for effective supervision and the consideration of all causal links.

A detailed statement on integrated supervision in Austria is available here to download.

Integrated Supervision in Austria (Format: pdf, Size: 470,6 KB, Language: English)

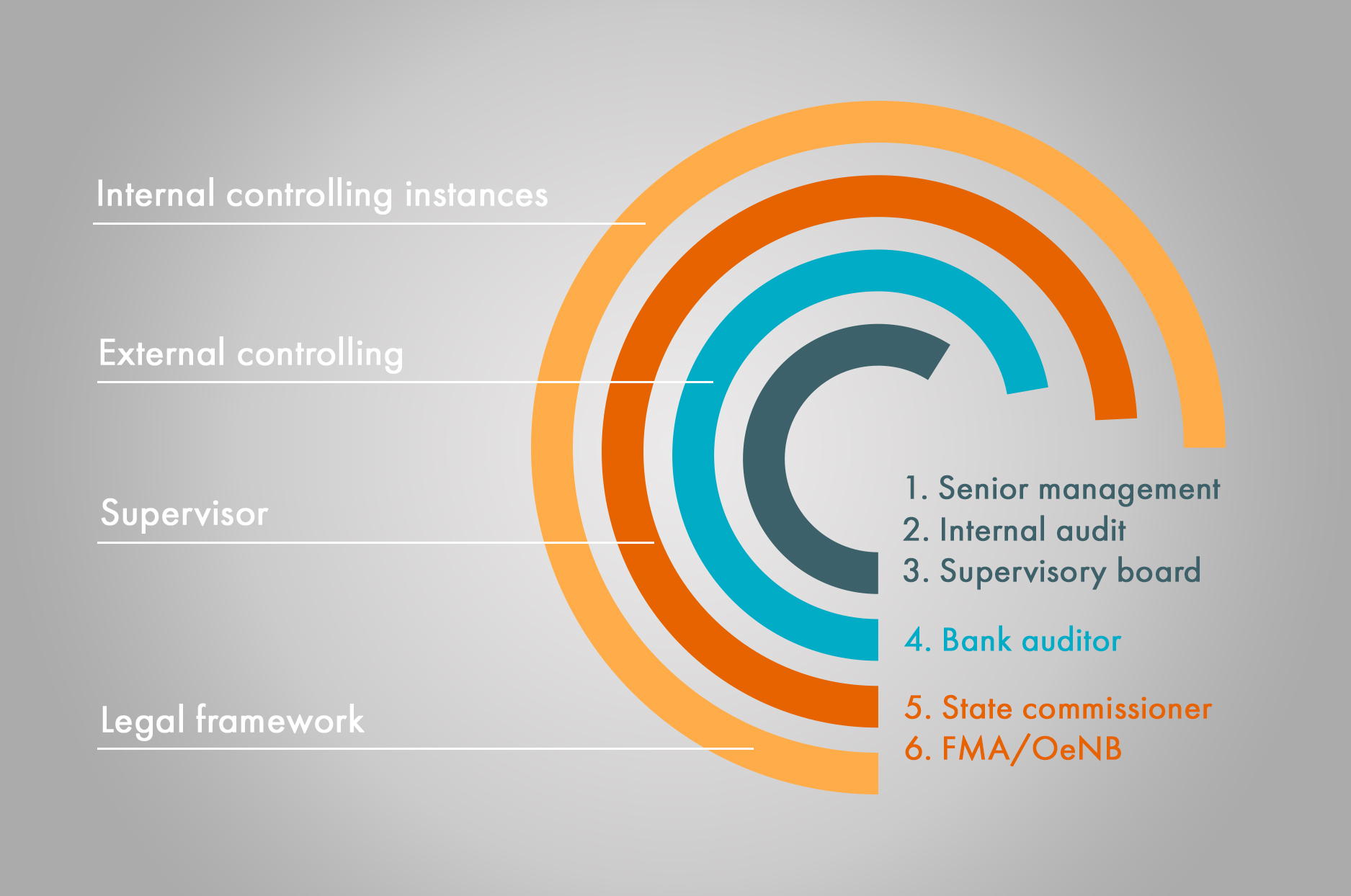

The hierarchy of supervision

Every efficient and effective supervisory authority builds upon the work of upstream supervisory authorities. This is known as “the hierarchy of supervision”. The internal audit division of a financial institution is the first level of monitoring and control, the supervisory board and the auditors are the second level, which although appointed by the entity are filled with independent external experts. The governmental supervisory authority only emerges as the third level.

In Austria, the supervision of the financial markets is performed by three institutions. In general terms:

- it develops and defines the legal framework conditions together with the Federal Ministry of Finance (BMF), which are then passed through the Austrian parliament (legislation);

- the Oesterreichische Nationalbank (OeNB) monitors the stability of the financial market as a whole (macro supervision), and is responsible for the supervision of payment and settlement systems, as well as being involved in banking supervision and

- the Financial Market Authority (FMA ) monitors and controls the individual financial institutions and players (micro supervision).

All three institutions cooperate closely in an integrated way with one another and collectively form the Austrian system for the supervision of the financial market.

International cooperation

The FMA works in many international, particularly European, committees to draw up common supervisory standards and in so doing to represent the interests of Austria as a financial marketplace. In light of the globalisation of the financial economy, the intensification of international cooperation within operative supervision is becoming increasingly significant.