An issuer, which publicly offers securities or intends to apply for admission to a regulated market of the Vienna Stock Exchange must prepare a comprehensive securities prospectus containing key information on the issuer and the securities to be issued. In line with the legal provisions contained in Regulation (EU) 2017/1129 and the Austrian Capital Market Act 2019 (KMG 2019; Kapitalmarktgesetz 2019), the Financial Market Authority checks these securities prospectuses for completeness, coherence and comprehensibility.

Important information about checking of prospectuses can be found here.

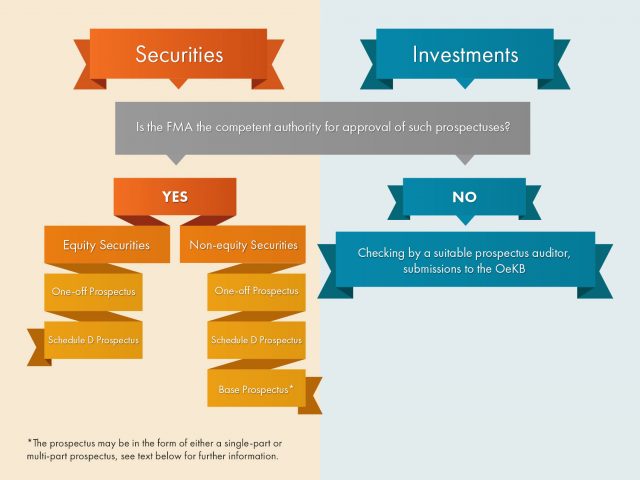

Approval by the FMA

A securities prospectus must be approved by the FMA’s prospectus approval unit and must be published in a legally valid way. The securities prospectus may be designed as either single-part or multi-part. Similarly, supplements to previously approved securities prospectuses also require approval by the FMA. Such supplements must be prepared by the issuer when important new facts occur or original inaccuracies are discovered between the approval of the prospectus and the final closure of the public offering or, if it occurs later, the opening of trading on a regulated market.

The FMA is responsible for scrutinising and approving prospectuses and supplements of any public offering of securities or their admission to trading on a regulated market of Wiener Börse AG. In addition the FMA is also responsible for the approval of a universal registration document, which allows issuers making frequent use of the capital markets to obtain the status of frequent issuers thereby permitting the time frame for prospectus approval to be shortened from ten banking days to five. Provided that the offering of securities does not exceed a total value of EUR 5 million within twelve months, a simplified prospectus may be drawn up pursuant to Annex D KMG 2019.

The correctness of the information in a securities prospectus is not the subject of the FMA’s legal checking. The respective issuer assumes liability for the correctness of the information listed in a securities prospectus.

Current news

On 26.03.2021 the Delegated Regulation (EU) 2021/528 as regards the minimum information content of the document to be published for a prospectus exemption in connection with a takeover by means of an exchange offer, a merger or a division was published in the Official Journal of the European Union.

On 26.02.2021 Regulation (EU) 2021/337 as regards the EU Recovery prospectus was published. The FMA advises in this context about the new temporary opportunity for the simplified “Covid-Recovery-Prospectus” as well as the similarly temporary extension of the cancellation period in the case of supplements for prospectuses stated in Article 23 of Regulation (EU) 2017/1129.

On 14.09.2020 Delegated Regulation (EU) 2020/1272 amending and correcting Delegated Regulation (EU) 2019/979 as well as Delegated Regulation (EU) 2020/1273 amending and correcting Delegated Regulation (EU) 2019/980 were published in the Official Journal of the European Union.

On 04.03.2021 ESMA published the Guidelines on disclosure requirements under the Prospectus Regulation. The FMA has declared itself fully compliant.

The FMA refers to the published communication about the obligation to publish a supplement in relation to COVID-19.

The ESMA notification portal went live on 01 December 2020. Further information can be found under the IMPORTANT ANNOUNCEMENT REGARDING THE NOTIFICATION TO THE NEW-ISSUE CALENDAR UND THE FILING OF THE FINAL TERMS.

On 01.10.2019 ESMA published the Guidelines on Risk Factors under the Prospectus Regulation. The Guidelines have applied with effect from the entry into force of Regulation (EU) 2017/1129 on 21.07.2019.

On 05.05.2021 ESMA updated the Q&As on the Prospectus Regulation.

On 30.09.2020 ESMA published a Public Statement QA Update Prospectus. The statement informs about old Q&As that were still published under the Prospectus Directive and the applicability of the CESR Recommendations relating to “specialist issuers”.

Contact

Finanzmarktaufsicht (FMA)

Division III/4 – Prudential Supervision Asset Management, Prospectuses, and Consumer Information

Otto-Wagner-Platz 5

1090 Vienna

[email protected]

Further information:

Obligation to produce a prospectus