Background and Objective

The European Commission presented the legislative proposal for MiCAR on 24 September 2020 as part of the Digital Finance Package for digitally transforming the financial sector. In addition to the proposal for MiCAR the package comprises of a legal act on digital operational resilience in the financial sector (DORA; Digital Operational Resilience Act), a proposal for a pilot regime (“DLT Pilot”) for market infrastructures based on distributed ledger technology (DLT) as well as strategy for a digital financial industry.

Regulation (EU) 2023/1114 on markets in crypto-assets was published in the Official Journal of the European Union on 9 June 2023 and entered into force on 29 June 2023.

The Regulation of the European Parliament and of the Council on markets in crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (“MiCAR “) the European Union has enacted a harmonised legal framework for the market in crypto-assets, which applies for both traditional institutions in the financial sector as well as new players in the crypto ecosystem. They are required to meet a range of specific requirements in order to benefit from a regulated status recognised at European level.

MiCAR ’s objective is to create a harmonised European regulatory framework for the public offering, admission to trading and provision of services in relation to crypto-assets in the European Union while also enabling the promotion of innovations and harnessing the potential of crypto-assets while maintaining financial stability and investor protection.

MiCAR specifically regularizes transparency and disclosure obligations for the issuance and trading in crypto-assets, authorisation requirements and ongoing supervision of crypto-asset service providers (CASPs ) and issuers of crypto-assets, the orderly business organisation of issuers of crypto-assets as well as crypto-asset service providers, investor and consumer protection rules for the issuing trading and custody of crypto-assets as well as rules for fighting market abuse at crypto-trading venues.

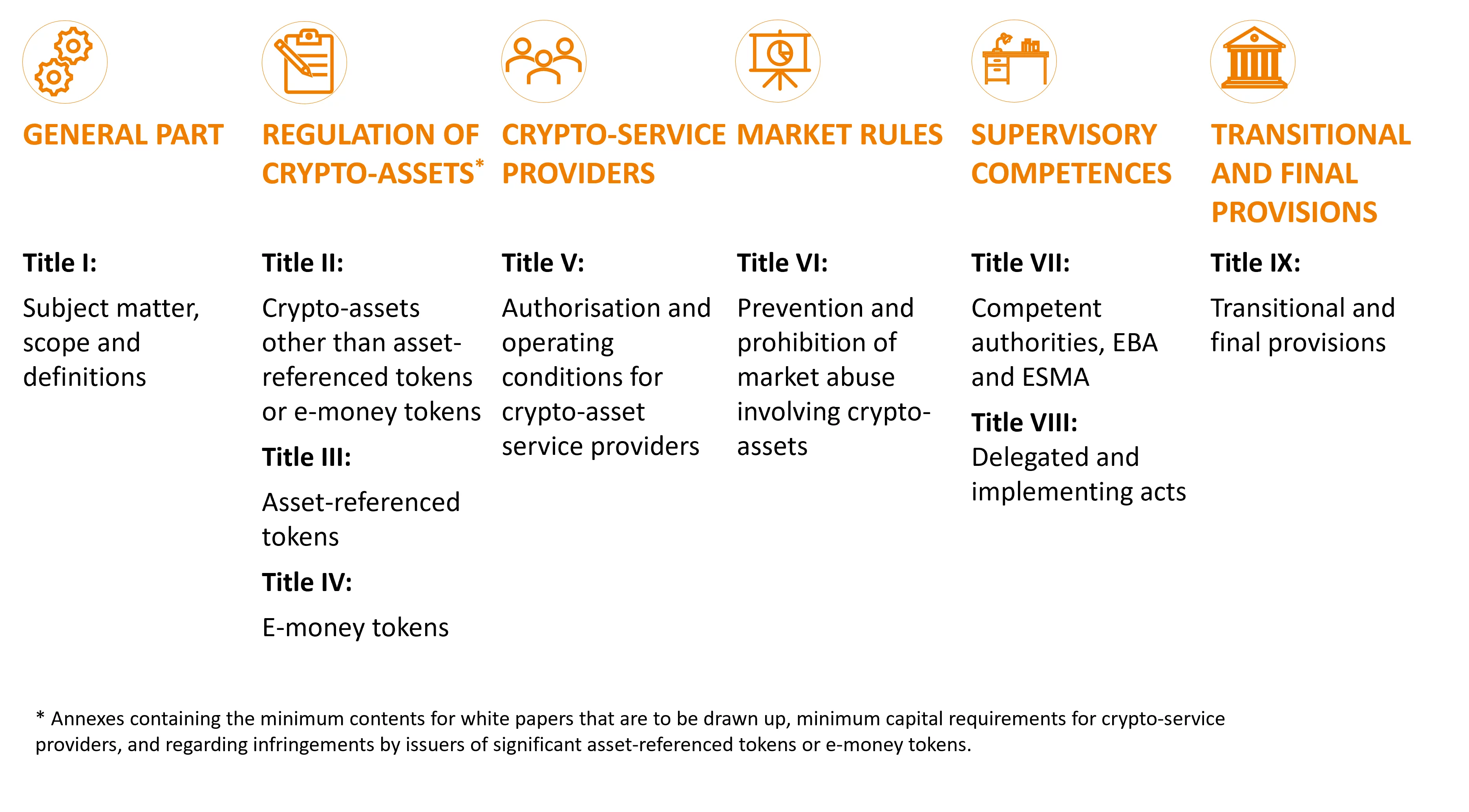

Provisions

The various provisions in MiCAR become applicable at different points in time.

- Provisions about asset-referenced tokens (ARTs) and e-money tokens (EMTs) contained in Titles III and IV apply from 30 June 2024

- Provisions about the authorisation and ongoing supervision of CASPs contained in Title V apply from 30 December 2024

- All other additional provisions in the MiCAR (especially Titles II and VI), which are not directly applicable under Article 149 (4) MiCAR apply from 30 December 2024

- In additional, individual articles have already applied since 29 June 2023.

At the same time, the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) are drawing up Regulatory Technical Standards, Implementing Technical Standards and Guidelines that further specify how MiCAR applies.

Quick links

ESMA – Guidelines, Recommendations and Technical Standards

ESMA – Markets in Crypto-Assets Regulation (MiCAR ) – Markets in Crypto-Assets Regulation (MiCAR )

EBA – Technical Standards, Guidelines & Recommendations – Asset-referenced and e-money tokens (MiCAR)

Classification and Obligations

Crypto-assets, that are not already covered by European financial services regulations (especially the Markets in Financial Instruments Directive (MiFID II)), are split into three main categories:

- asset-referenced tokens (ARTs),

- e-money tokens (EMTs) and

- other crypto-assets.

The scope of the requirements to which issuers of crypto-assets are subjected depends on the classification. For example, a white paper must be submitted to the competent authority for all tokens, although prior approval of the white paper is only required for ART and EMT issuers under certain circumstances.