Overview

Due to the large number of different regulations in relation to the provision of services there is no harmonised definition spanning all the legal acts of what constitutes a crowdfunding service. It is generally understood to mean that parties (project owners) looking for financing collect financial means through a brokering platform from a broad public group of investors. However, there are also models that exist that do not use a platform; however, they are not the subject matter for this page.

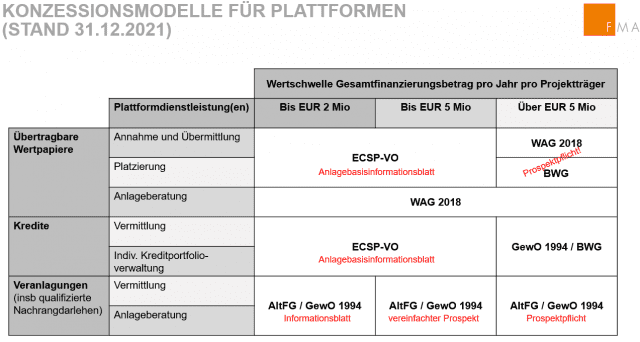

There is a national regime under the Alternative Financing Act (AltFG; Alternativfinanzierungsgesetz) and a European regime under Regulation (EU) 2020/1503 on European crowdfunding service providers (ECSPR) for crowdfunding. The European Regulation has applied since 10.11.2021. For the first time, there is now also a harmonised regulatory framework for the entire EU. The authorisation under the ECSPR stipulates a maximum financing volume of EUR 5 million per project owner and per year. The authorisation under the ECSPR does not apply above this threshold! The national regulations in the AltFG remain primarily predominantly interesting for local platforms that do not offer any transferable securities.

Two basic questions arise prior to starting a crowdfunding business model or investing on a crowdfunding platform:

- Do platforms or projects require authorisation by the FMA?

The obligation to have an authorisation depends on the type of the investment on the one hand (security, investments, loans, other) and the precise activity as well as financing volume.

- Do platforms or projects require a capital market prospectus or other information documents?

That depends on the type of the investment, the volume of the issuance and on potential exceptions.

To simplify, there are three ways of operating a crowdfunding platform:

1. As a European Crowdfunding Service Provider and therefore as the operator of a platform under the ECSPR. Depending on its authorisation it intermediate and place cross-border loans and securities as well as offering the individual management of loan portfolios. For this reason it is supervised by the FMA on an ongoing basis. Project owners must ensure that a Key Investment Information Sheet (KIIS) is drawn up for offerings on such platforms.

The threshold of EUR 5 million total financing volume per project owner within a 12 month period is of central importance. If this threshold is exceeded, then the authorisation under the ECSPR no long covers the provision of services with regard to this project owner and their offerings. Platforms and project owners must therefore take particular care to ensure that this threshold is not exceeded. For offerings over EUR 5 million, a licence under WAG 2018 or BWG is required, for the offering of investments in transferable securities on the platform, and the requirement to publish a prospectus is activated for the public offering of transferable securities.

In the field of credit intermediation there is no European alternative above the EUR 5 million threshold, in this case it is necessary to proceed in accordance with the respective national rules: in Austria credit intermediation is a banking transaction under the BWG, in the case that one of the listed business licence activities exists, e.g. for commercial financial advice. Since the exception in the ECSPR does not apply for the collecting of loans from deposit-taking business that requires a licence, loan-based crowdfunding models above the threshold are not generally permitted without the project owner having the necessary authorisation under the Austrian Banking Act.

2. As a licensed investment firm under MiFID II or WAG 2018, the operation of a crowdfunding platform is possible only for financial instruments (in particular transferable securities) and only above the value threshold. The ECSPR does not apply in this area. The project owner must in particular also take the obligation to publish a prospectus under the Prospectus Regulation into account.

Platforms wanting to be active both above and below the EUR 5 million threshold per project owner and year must accordingly possess two authorisations. Since the entry into force of the ECSPR the provision of services below the threshold has exclusively been permitted with an authorisation in accordance with this Regulation. Platforms that hold an authorisation (= a licence) under the WAG 2018, but wish to be active over the value threshold must therefore ensure that the threshold is not underrun.

3. As an Austrian crowdfunding platform under the Alternative Financing Act (AltFG; Alternativfinanzierungsgesetz) the operator of the platform is only allowed to offer its service in Austria. Only performing the intermediation of investments under the Capital Market Act 2019 (KMG 2019; Kapitalmarktgesetz 2019) does not require a licence, but instead requires a business licence. The FMA is not the competent authority for supervision of the business conducted over such platforms and their operators. The trade authorities are competent in this instance.

In any case, the operator is required to observe certain obligations as an Internet platform under the Alternative Financing Act (AltFG). Similarly, issuers also have some obligations under the AltFG. Depending on the volume involved, public offerings must be subject to the requirement to publish a prospectus, or may only be required to publish a shorter AltFG information document.

In the AltFG, strict thresholds also apply: issuers are not allowed to exceed a total financial amount within 12 months of EUR 2 million on AltFG platforms, and not collect more than EUR 5 million per year in total in the EEA (also outside the scope of the AltFG, e.g. on other ECSPR platforms) and in total the outstanding volume shall not be allowed to exceed EUR 5 million over the course of a 7 year observation period. Platform operators and issuers must monitor closely that these thresholds are not exceeded.

To summarise, from the existing national and European legal bases, the following authorisation requirements arise for operating different types of crowdfunding services:

Pursuant to Article 3 (1) ECSPR only legal entities are allowed to provide crowdfunding services with the corresponding authorisation. A licence (= authorisation) is also required for the provision of services within the scope of the Securities Supervision Act 2018 (WAG 2018). Whether a provider has an authorisation can be found in the FMA’s Company Database and should be checked prior to the conclusion of a transaction.