The Austrian Financial Market Authority (FMA) is expected to be responsible for the authorisation of Crypto-Asset Service Providers (CASPs) (Article 62 MiCAR) and the notification of crypto-asset services of certain financial entities for the provision of crypto-asset services (Article 60 MiCAR) under Regulation (EU) 2023/1114 on Markets in Crypto-Assets Regulation (MiCAR), once the national supplementary MiCAR legislation has entered into force.

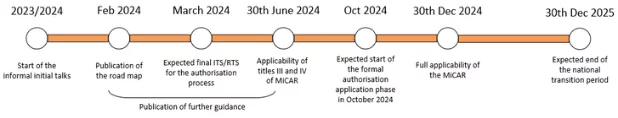

The following figure is intended to provide an overview of the MiCAR implementation timeline and future milestones leading up to the full applicability of MiCAR:

Pre-Authorisation Discussions and MiCAR Authorisation Process

The FMA has endeavored to conduct voluntary (informal) preliminary discussions with a number of potential applicants in order to provide information about the FMA’s expectations regarding the content and quality of potential authorization applications, as well as about the applicants themselves, and to obtain information about the applicants’ respective undertakings and business models. In this way, the FMA wants to ensure that all applications submitted to the FMA meet the highest quality standards and can be processed efficiently.

All interested companies are encouraged to contact the FMA as early as possible to allow sufficient time for preparation and coordination. Those companies that are already making concrete preparations to apply for authorization as CASPs in Austria are invited to inform the FMA of their interest in scheduling an introductory meeting by sending an e-mail to the following address: [email protected]

When requesting a meeting, please answer as many of the questions listed in the attached Excel spreadsheet as possible and submit it together with all relevant documents.

Questionnaire for initial preliminary meeting (Format: xlsx, Size: 25,5 KB, Language: English)

Answers to legal questions regarding MiCAR

Any legal inquiries regarding MiCAR can only be processed and answered once the corresponding national legislation accompanying MiCAR has entered into force and the FMA has been legally designated as the competent authority. In anticipation of this, the FMA endeavors to communicate its regulatory expectations and standards in bilateral discussions with prospective applicants and by providing explanatory information and documents on its website.

How long will it take to receive a CASP authorisation?

It is not possible to give a general indication of how long the application process will take. The time required will depend on the quality of the application, the documentation provided, the complexity of the applicant’s corporate structure and the underlying business model.

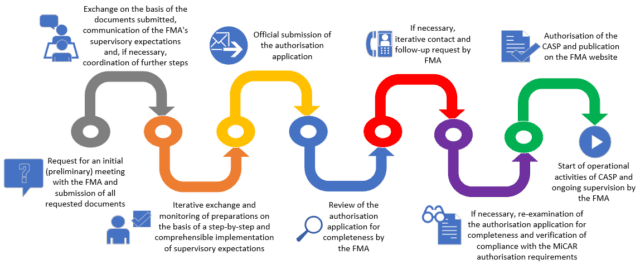

The following figure provides a schematic overview of the intended progression of a successful approval process:

Recommendations for preparing a CASP authorisation application

It is recommended that prospective applicants prepare a high-quality application for authorisation and submit it in a timely manner. The following is an indicative outline of the FMA’s expectations regarding the content and structure of the application, as well as for an informed preliminary dialogue with prospective applicants:

- Clarification of the scope of application: Prospective applicants are requested to provide a detailed description of their legal assessment explaining which CASP services are applicable to their business model. In addition, an explanatory description of all business activities (including those outside the scope of MiCAR) must also be provided.

- Prospective applicants should conduct a self-assessment of the specific need to adapt their organizational structure and ongoing business operations to the relevant provisions of MiCAR. This should include a target/actual comparison and a project timeline for the necessary adjustments.

- Consideration should be given to the use of qualified (external) legal counsel to assist in the preparation, processing and completion of the authorisation application and the incorporation of the comments and guidance provided by the FMA.

- Prospective applicants are welcome to request an informal information meeting with the FMA (see above) to learn about the FMA’s specific expectations regarding potential authorisation applications and/or prospective applicants. It is also an opportunity to provide the FMA with a detailed overview of your organization and business model prior to the formal submission of the authorisation application. The FMA encourages you to take advantage of this opportunity, as it will help to increase the efficiency of the application process.

- The handling of authorisation applications usually proceeds in an iterative manner, during which the FMA may request further clarifications or the provision of additional documents. The more promptly the improvement instructions are implemented or the better the required and subsequently requested documents are prepared, the more efficiently the FMA can conduct the authorisation procedure.

- Applicants are requested to refrain from submitting an incomplete application for authorisation! The FMA requires applicants to submit a complete, well-structured, and properly prepared application.

Ensure compliance with relevant provisions on the prevention of money laundering and terrorist financing

CASPs are required to comply with and demonstrate compliance with applicable regulations regarding the prevention of money laundering and terrorist financing. Therefore, the following documents, information and records must be provided during the authorisation process.

- A detailed, complete, and business model-specific description of the internal control system, as well as the strategies and procedures for the prevention of money laundering and terrorist financing.

- Detailed, complete, and business model-specific risk analysis at the entity and customer level. If an entity is already operating, the risk analysis must be supported by relevant figures and data. Where there is no operational business, estimated and projected figures and data should be provided.

- Evidence that a designated Anti-Money Laundering Officer (AMLO) and deputy have been appointed; evidence of professional fitness (e.g. curriculum vitae and training certificates) and personal probity (e.g. criminal record); and, where available, evidence of an internal fit and proper assessment. The fit and proper assessment of the AMLO by the relevant department is an important part of the authorisation process.

The authorisation process does not include the approval of processes, systems and procedures for the prevention of money laundering and terrorist financing. Upon receiving an authorisation, CASPs are subject to the Austrian Federal Act on the Prevention of Money Laundering and Terrorist Financing in Financial Markets (FM-GwG) and must comply with all relevant provisions for the prevention of money laundering and terrorist financing.